Voluntary Carbon Market services

Real time insights of activity and projects in the voluntary offset market

Scroll for more

Voluntary Carbon Market

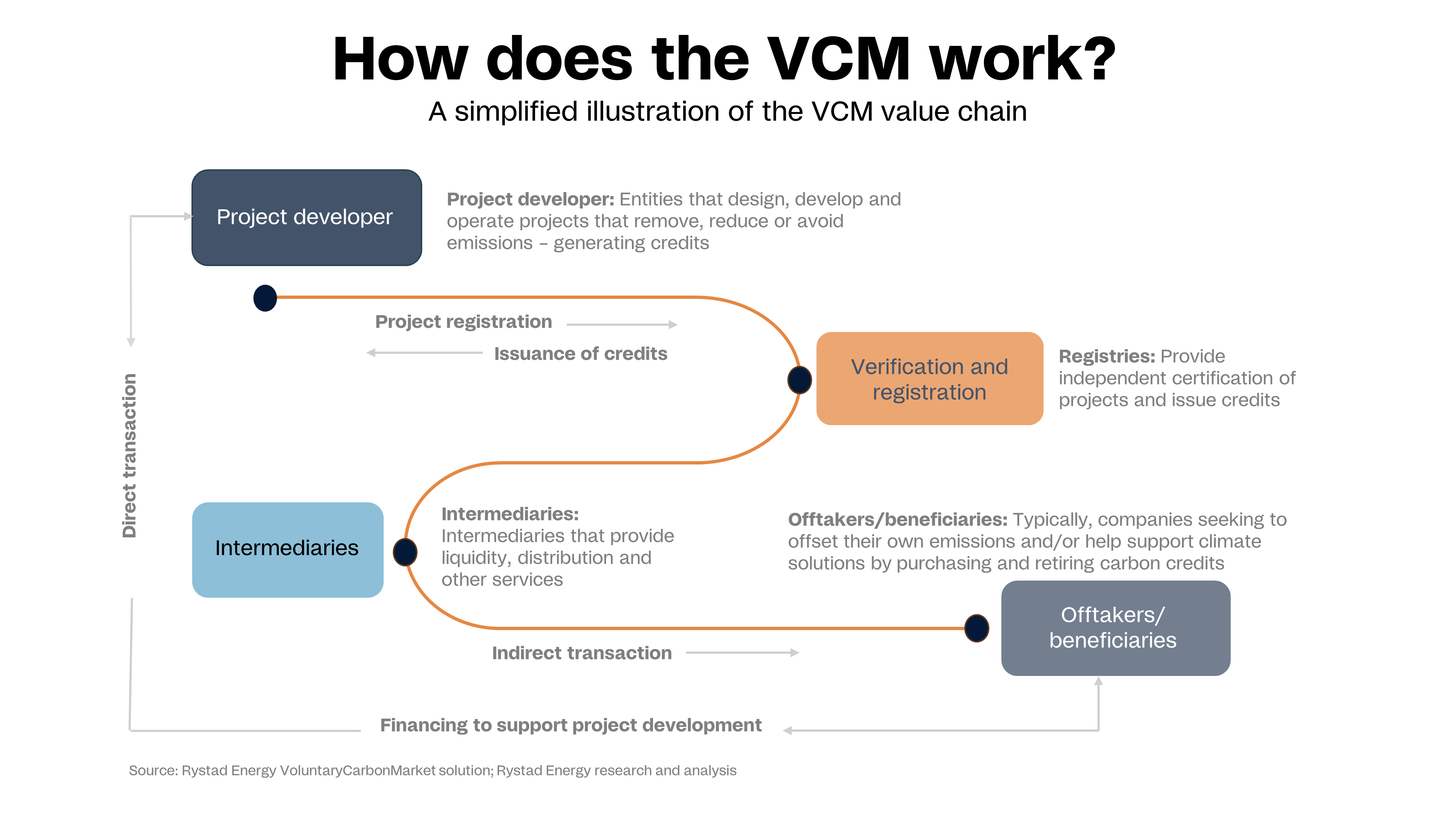

The voluntary carbon market (VCM) is at a pivotal inflection point. Since its rise to prominence, the market has been challenged across the entire value chain. Yet, opportunities for improvements are plentiful, and a wave of reforms is set to restore market confidence.

Rystad Energy is proud to launch coverage of VCMs, which are one of our services aimed at guiding companies through the energy transition with high-quality data and insights. We offer coverage across all major registries (including tech-based removals), policy updates, buyer benchmarking and analysis across sectors, granular project overviews and more, and we aim to be a trusted knowledge partner in these opaque and fast-moving markets.

Our services allow clients detailed and timely insights into the rapidly moving voluntary offset space. With daily updates across all major registries and harmonization across platforms, the tool enables a deeper understanding of the market trends and corporate strategies that shape the future of voluntary carbon credits. Monthly and quarterly analytics covering all policy and regulatory updates complete the package.

Key highlights

Beneficiary overviews

Buyers and users of credits and their specific strategy is also part of the toolset, enabling an understanding of different player activity

Registries coverage

In addition to the major registries, several smaller registries are also included, offering a more nuanced perspective on the market – all standardized, harmonized and updated daily to facilitate analysis across the market

Carbon Dioxide Removal analysis

Dive into key trends, transactions, volumes and other data points to better analyze the state of engineering based carbon dioxide removal technologies

the Voluntary Carbon Market research covers all segments of the offset ecosystem

Our experts views

Carbon markets offer an enticing structure: a marketplace that can scale decarbonization, where one credit bought is one tonne of carbon dioxide equivalent (CO2e) reduced, avoided or removed. They allow money to flow towards the decarbonization efforts that have the lowest cost – wherever they are located in the world and whatever form they take. They can fund decarbonization projects that would never have gotten off the ground without credit generation, can involve significant additional benefits for communities, and could prove an essential tool in the decarbonization toolbox. In a nutshell, the world needs functional VCMs to reach aggressive decarbonization targets.

Our experts views

Carbon markets offer an enticing structure: a marketplace that can scale decarbonization, where one credit bought is one tonne of carbon dioxide equivalent (CO2e) reduced, avoided or removed. They allow money to flow towards the decarbonization efforts that have the lowest cost – wherever they are located in the world and whatever form they take. They can fund decarbonization projects that would never have gotten off the ground without credit generation, can involve significant additional benefits for communities, and could prove an essential tool in the decarbonization toolbox. In a nutshell, the world needs functional VCMs to reach aggressive decarbonization targets.

Ready to explore further?

Our experts will answer your questions and help you find a solution for your specific needs.