Trading Signals & Macro Trends

Exclusive insights - Stay ahead of the market

Crafted by experts

Receive weekly oil trading insights

We publish a wide range of trading insights each week for our clients. This is your chance to receive a curated sneak peek.

Delivered straight to your inbox, our signals draw on high-frequency, short-term data. They cover oil supply, demand, real-time consumption, downstream refining and OPEC+ decisions.

Stay ahead of market shifts. Subscribe today.

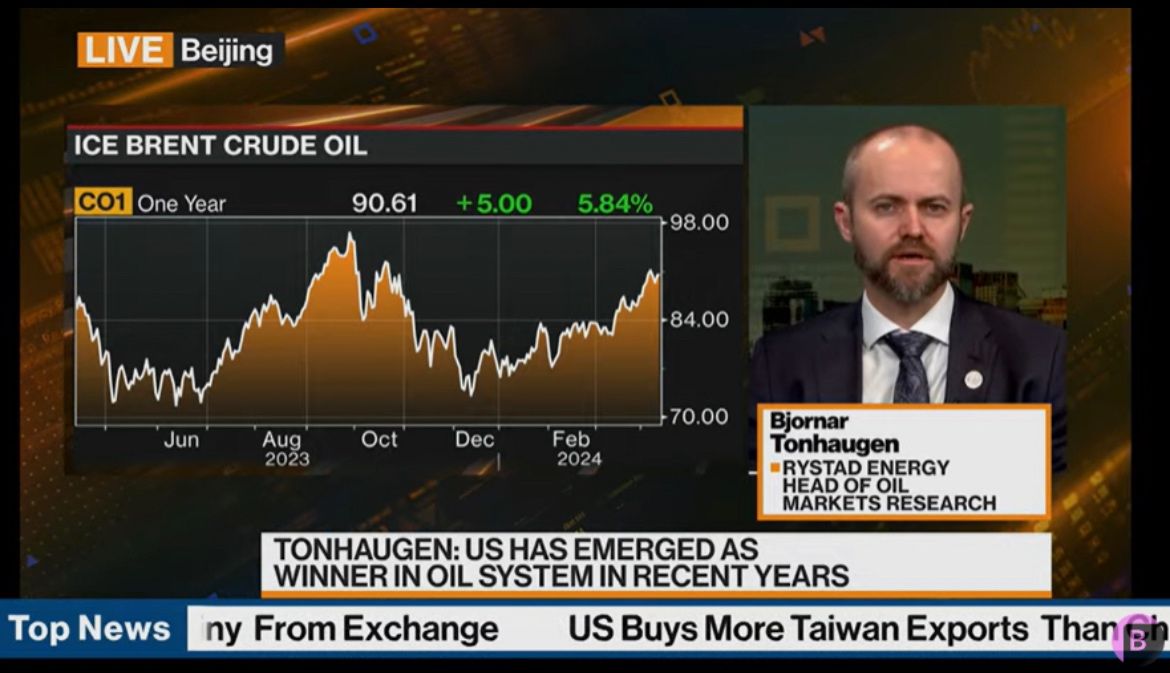

Features in the media

Unable to load form. Please check your cookie settings and turn off content blockers. You can reload this page to try again.

Loading form...